The EPF had previously provided the extension from April 2020 until August 2020 as a response to. The following information are vital and should be updated to the EPF before the next contribution payments due date for the related month.

Wezmart Connect Kwsp Payment Due Date Extention March Salary Kwsp Payment Due Date Extended From 15 April 2020 To 30 April 2020 Submission Date Remains The Same On 15 April 2020

The employer needs to pay both the employees and the employers share to the EPF.

. The due date for submission of data and payment of monthly tax deduction for march 2020 remuneration as well as cp38 has been extended to 30 april 2020. 16 is extended to 31 July 2021. Kwsp Payment Due Date 2 - I just a minority shareholder in this two companies are having loss making more than 5 years and i was not received any payment or income from this two companies.

KUALA LUMPUR 30 December 2020. The Employees Provident Fund EPF is extending the date for employers to remit their mandatory contribution for the months of September 2020 until December 2020 from the 15th to the 30th of each month respectively. Upon the late payment of EPF.

EPF Contribution Payment deadline. This is in line with the original contribution payment date determined by. In this context ESI is similar to the PF.

The PF annual return due date is 25th April of the following year. Ie if you want to deposit PF contribution for the month of June then it has to be done on or before the 15th of. Changes In Employers NameStatus And Address It is your duty as an employer to update the EPF within 14.

Ie EPF contributions pertaining to salarywages for JAN is to be remitted to Govt. PF payment due date. The employer needs to pay ESI return on a half-yearly basis and the due dates are also fixed as.

If any delay payments. Payment and filing for the PF return date are probably the same and you can process it at the same time. Https Www Kwsp Gov My Documents 20126 1275785 7 Easy Guide Outstanding Lpc Div Pdf from Epf payment due date is the date by which pf from the employees.

EPF payment due date is the date by which PF from the employees salary should be deducted. 15th June 2012 as increased by grace period of 5 days. Delay in the deposition of Provident Fund.

Due date for payment of Provident Fund contributions is 15 days from the end of month in which wages are paid plus grace period of 5 days. Therefore the Contribution Month is February 2018 and it has to be paid either before or on 15 February 2018. 15th of the following month Sources from KWSP Fine for Late payment contribution.

However the due date of PF return and the due date of PF payment are both the same ie. Therefore the due date of the PF return is the same as the payment date and that is before the 15th of the following month. Every employer makes the ESI payment on a monthly basis and the payment is given to the ESI department.

Check the infographics below for a quick view of the updated extended deadlines so that you will never miss a deadline prepare timely filing of. Is further extending the date for employers to remit their mandatory contribution for the salary month of March 2020 April contributions from the previously announced date of 24 April to 30 April 2020. The lower dividend rate between Simpanan Konvensional and Simpanan Shariah for each respective year with an additional one 1 percent.

EPF helps you achieve a better future by safeguarding your retirement savings and delivering excellent services. The date for employers to remit their mandatory Employees Provident Fund EPF contribution for 2021 is now the 15th of every month starting January 2021. When And What To Contribute.

The due date to furnish the TDS Certificate to employees in Form No. On or before the 15th of every month. The minimum fine is RM 5 hence if the monthly fine is calculated to be less than RM5 it will be charged at RM 5 per month.

Due date for EPF payment for the month of July 2016 is 15 Aug Since 15 Aug is national hoilday so is due date for payment of EPF for July 2016 can be considered as 16 Aug - Others. If contributions are made later than the 15th of following month if the 15th is a holiday the deadline will be the last working day before the 15th a fine of 6 per annum for each day overdue will be charged. While the Movement Control Order MCO phase 3 is extended to 28th April 2020 you must be wondering whats the last due date to make payment for EPF SOCSO EIS SST filing of Tax Forms with LHDN documents with SSM.

Salary for January 2018. As per EPF Act the EPF contributions pertaining to SalaryWages shall be remitted to Govt. This is the date by which you have to submit the PF which you will deduct from your employees salary.

However keeping in view the problem during lockdown being faced by the employers in filing ESI contribution for the contribution period April 2020 to September 2020 within 42 days the government had relaxed due dates and onetime relaxation was granted for filing of contribution for contribution period. Late Payment Penalty in EPF. Ensure that the employees share of the payment for the contribution months being applied for April May or June has been paid up.

Due date on Sundaypublic holiday. Chief EPF Officer Alizakri Alias said Normally employers must remit their contributions by the 15th of every month and we had announced yesterday that for April we. Employer must make monthly payment on or before 15th of the month.

Within 15 days of close of each month. In light of the extension of the Conditional Movement Control Order CMCO and its subsequent impact on business activities in the country the is extending the date for employers to remit their mandatory contribution for the months of May 2020 until July 2020 from the 15th to the 30th of each. KUALA LUMPUR 7 September 2020.

This should be done on or before the 15th of every next month. Quarterly TDS certificates in respect of tax deducted for payments other than salary for the quarter ending March 31 2021 is to be issued by 30 June 2021. The due date for ESI is the 15th of the following month which can also exceed or change according to the department rules.

EXTENSION OF MAY JUNE AND JULY 2020 CONTRIBUTION PAYMENT DATE. PF has two due dates they are payment due date and the ECR filing due date. This has to be done on or before the 15th of next month.

27 rows Ensure that all monthly contribution payments both employee and employer portions up to the February 2020 contribution date January 2020 wage are in order. Thus if wages pertaining to April 2012 is paid on say 7th May 2012 due date for payment of Provident Fund contribution is 20th June 2012 ie. But there are other opinions as given below citing some case laws.

The minimum late payment charge imposed is RM10.

Kwsp Will Begin Remittance On April 20th And Members Should Expect To Receive Their Funds In 1 To 3 Working Days Leh Leo Radio News

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Employees Provident Fund Malaysia Wikiwand

Epf Employer Contribution Advisory Services Employer Covid 19 Assistance Programme E Cap Yau Co

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

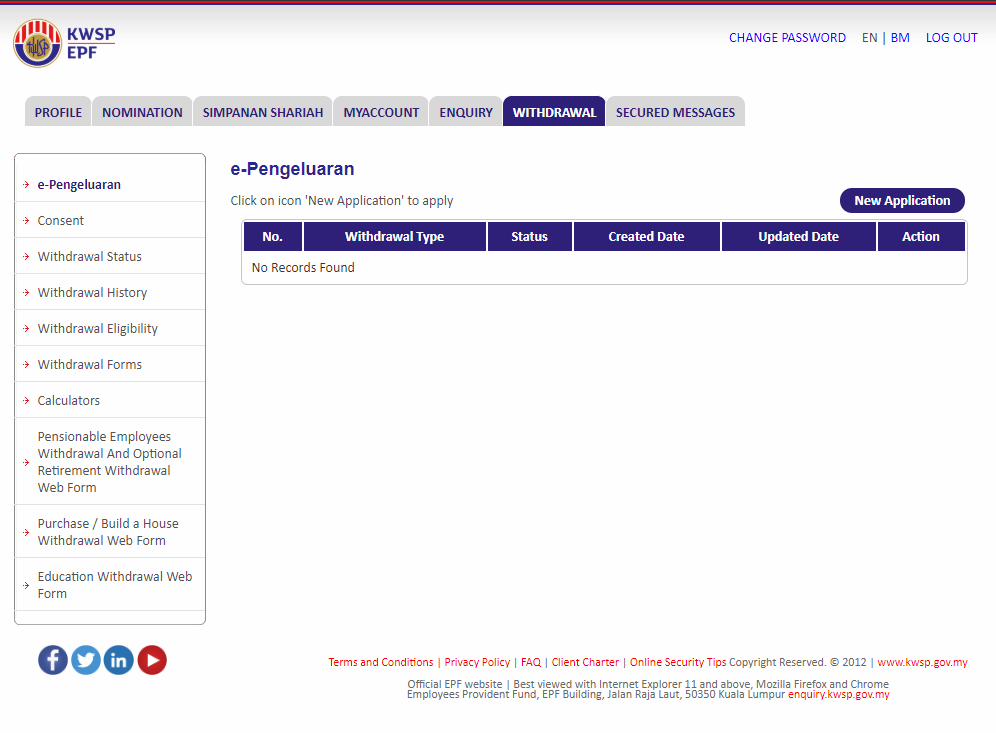

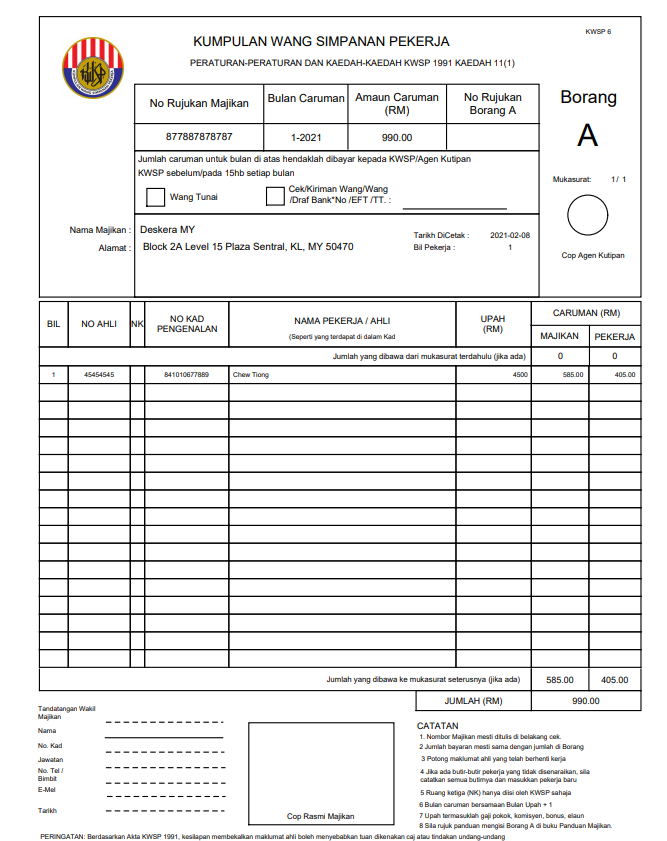

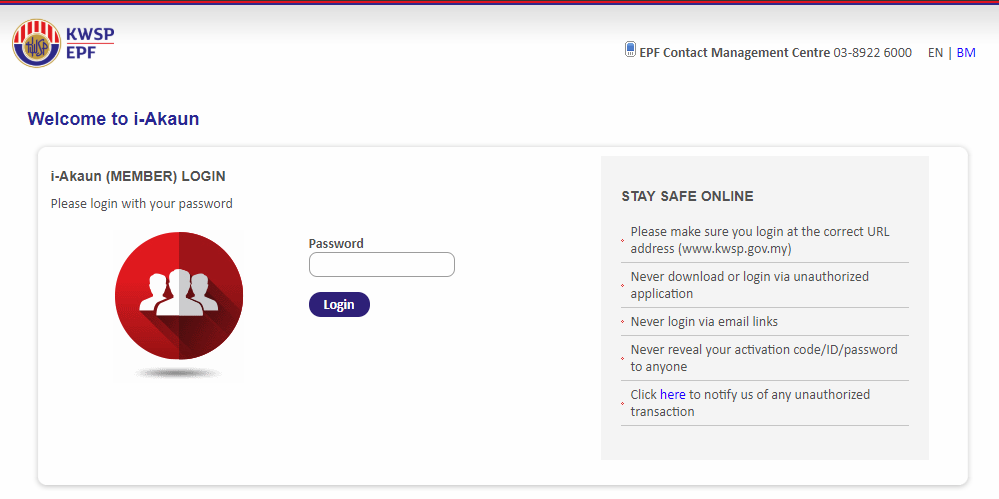

How To Generate Kwsp Borang A Form Txt Csv File Using Deskera People

Kwsp Will Begin Remittance On April 20th And Members Should Expect To Receive Their Funds In 1 To 3 Working Days Leh Leo Radio News

Kumpulan Wang Simpanan Pekerja Dear Employers Follow These Simple Steps To Submit The 17a Khas 2020 Form Without Having To Visit An Epf Branch This Alternative Solution Allows You To Submit

Employer S Contributions To Eis Epf And Socso In Malaysia Yh Tan Associates Plt

Extended Deadlines Lhdn Kwsp Ssm More

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia

Selected Epf Members To Receive Rm10 000 From 18 April 2022

Further Epf Withdrawals Will Burden Younger Generations In The Future

How Epf Digitalising Its Customer Journey

Jurlim Salim Payment Schedule For I Lestari Kwsp Epf Facebook

4 Simple Steps To Use Your Epf Money To Buy House In Malaysia